Dear friends,

In case you have not submitted your ITR and you have your FORM 16 from a single company then you can easily do it online following the below steps:

1. you can download the ITR from excel utility

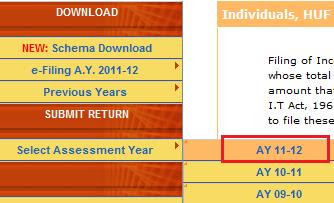

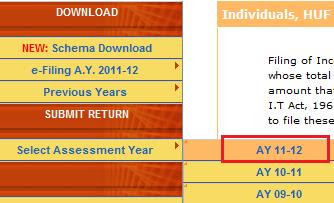

https://incometaxindiaefiling.gov.in/portal/individual_huf.do

Select assessment year 2012-2013 (Funny, you got salary in 2011-2012 but you need to file for for 2012-2013) :D

If you have no loss/income from properties to file then use ITR1.

If you have loss/income from properties for example home loan then use ITR2.

2. Then fill below sheets (Red is mandatory, if default value is there for red items then that should work for you)

2.1.Sheet: PART A - GENERAL

2.6. Click button Calculate Tax followed by button Generate. An XML file will be generated in the folder where EXCEL file exists.

3. Login at the site https://incometaxindiaefiling.gov.in/portal/individual_huf.do

(Register using your PAN, if not done at https://incometaxindiaefiling.gov.in/portal/register.do?screen=registerPage1)

Then select as shown below.

4. Upload the xml file generated in 2.6

5. Download the acknowledgement zip/pdf from the given link for sure. As I did not get it in my inbox immediately :D. It came after days.

6. To open the pdf use password pan in lower case followed by ddmmyyy. Take a print, sign it and send it to by post to address given in the pdf at bottom.

7. In few weeks you will get email about the successful return with attachement. Take print of the pdf and put in your financial folder.

That is it.Happy efiling!

If you find anything missing, please leave a comment.

If this post helped you please click PLUS 1 (+1)

In case you have not submitted your ITR and you have your FORM 16 from a single company then you can easily do it online following the below steps:

1. you can download the ITR from excel utility

https://incometaxindiaefiling.gov.in/portal/individual_huf.do

Select assessment year 2012-2013 (Funny, you got salary in 2011-2012 but you need to file for for 2012-2013) :D

If you have no loss/income from properties to file then use ITR1.

If you have loss/income from properties for example home loan then use ITR2.

2. Then fill below sheets (Red is mandatory, if default value is there for red items then that should work for you)

2.1.Sheet: PART A - GENERAL

2.6. Click button Calculate Tax followed by button Generate. An XML file will be generated in the folder where EXCEL file exists.

3. Login at the site https://incometaxindiaefiling.gov.in/portal/individual_huf.do

(Register using your PAN, if not done at https://incometaxindiaefiling.gov.in/portal/register.do?screen=registerPage1)

Then select as shown below.

4. Upload the xml file generated in 2.6

5. Download the acknowledgement zip/pdf from the given link for sure. As I did not get it in my inbox immediately :D. It came after days.

6. To open the pdf use password pan in lower case followed by ddmmyyy. Take a print, sign it and send it to by post to address given in the pdf at bottom.

7. In few weeks you will get email about the successful return with attachement. Take print of the pdf and put in your financial folder.

That is it.Happy efiling!

If you find anything missing, please leave a comment.

If this post helped you please click PLUS 1 (+1)